This Brim Financial review will give you a comprehensive overview of the Canadian Company and the full suite of consumer and business credit cards that it offers. Also, our brim referral code is listed below if you want some free cash!

Known for their state-of-the-art mobile app, versatile points system, and lack of foreign exchange fees, Brim Financial’s Mastercards are a must-have for any financially-savvy Canadian consumer.

Also, make sure to check out our Brim Referral Code section at the bottom — You can collect $10 in points when you sign up for a new Brim Financial Mastercard, in addition to nearly $500 in free bonuses! Read on to get the full details, as well as our opinion on what Brim has to offer.

Table of Contents

What Is Brim Financial?

Brim Financial is a Canadian financial services provider known for its consumer credit cards. Based in Toronto, Brim Financial has built one of the best online credit card portals for consumers. It’s super easy to manage your card online, and there are a lot of features and perks built into the platform.

If you’re looking for a basic credit card with no account fees, no exchange fees, and cashback — then read on. A Brim Financial Mastercard might be exactly what you’ve been looking for.

Why Go With Brim? Brim Mastercard Review

Brim Financial offers an alternative to credit cards from Canada’s big banks and is a lot more consumer-friendly than its overly-corporate alternatives. Personally, I’ve had a Brim Financial Mastercard for over a year now, and it has become my go-to credit card for all of my purchases.

Here are a few things that I love about Brim:

- Zero foreign exchange fees — Want to go traveling? Save up to 2% on foreign exchange fees compared to other credit cards. This will quickly become your go-to credit card for all foreign purchases.

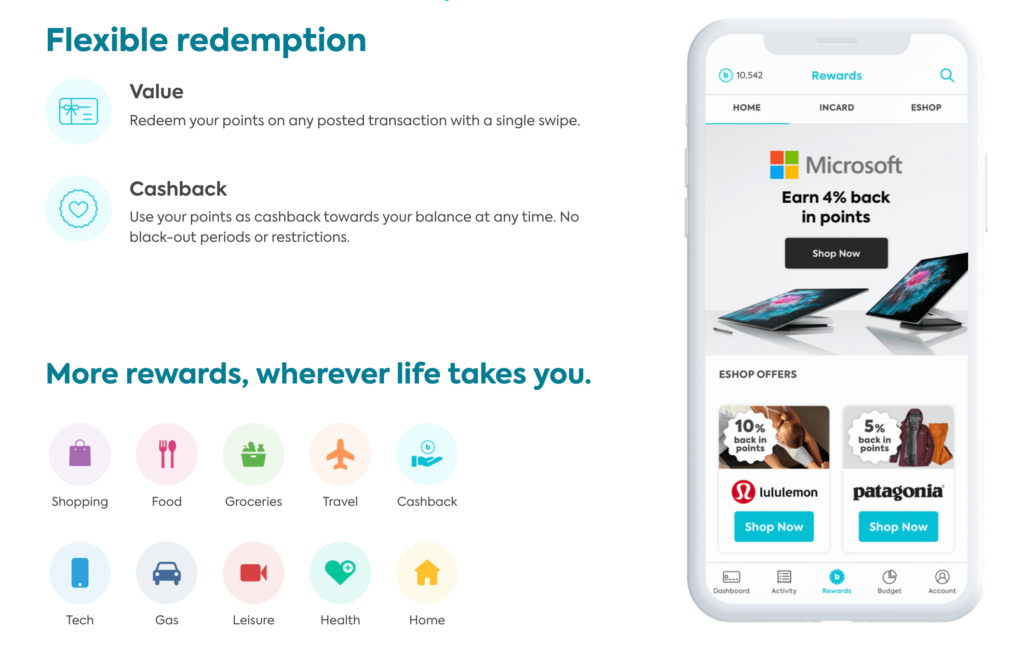

- Up to 2% cashback —Regardless of what you buy, you’ll always get 2% back (or 1% if you have the basic Brim Mastercard). And rather than only being able to redeem it for select items, you can redeem it against ANY purchase on your card.

- In-Card offers — If you shop at some Brim partners, you’ll receive extra rewards automatically. I receive double the points for my Netflix & Spotify subscriptions, as well as all of my Amazon purchases!

- eShop offers — You can earn extra rewards by doing some of your shopping through Brim’s eShop and paying with your Brim Financial card. I received triple the points for buying my new Macbook this way!

- 0% Installment payments — Making a big purchase? Brim will allow you to break it down into smaller monthly payments spread out across 12, 16, 20, or 24 months with 0% interest!

- Birthday bonuses! — Every time my birthday comes around, Brim sends me $5 in points! It’s not much, but it’s a nice, personal touch that I appreciate.

In addition to all of those features, Brim also offers some powerful insurance options to its cardholders. These policies include:

- Extended Warranty Insurance — Brim will usually double your manufacturer’s warranty for items purchased with your card.

- Purchase Security — If you purchase something through your Brim Mastercard, you’re protected if your item gets stolen, lost, or damaged. When my phone received water damage on the beaches of Colombia, Brim paid for the repairs. It works!

- Common Carrier Accident Insurance — If you purchase a plane/train/bus/boat ticket through your card and you get into an accident, you’re covered with a policy for both injury and death.

There’s also Mobile Device Insurance, Enet Ticket Protector insurance, and more. But, we’re not going to cover every punctuation mark in this article since the policy depends on which Brim Mastercard you hold.

If you want to learn more about the insurance policies each card offers, then check out the legal page for more details.

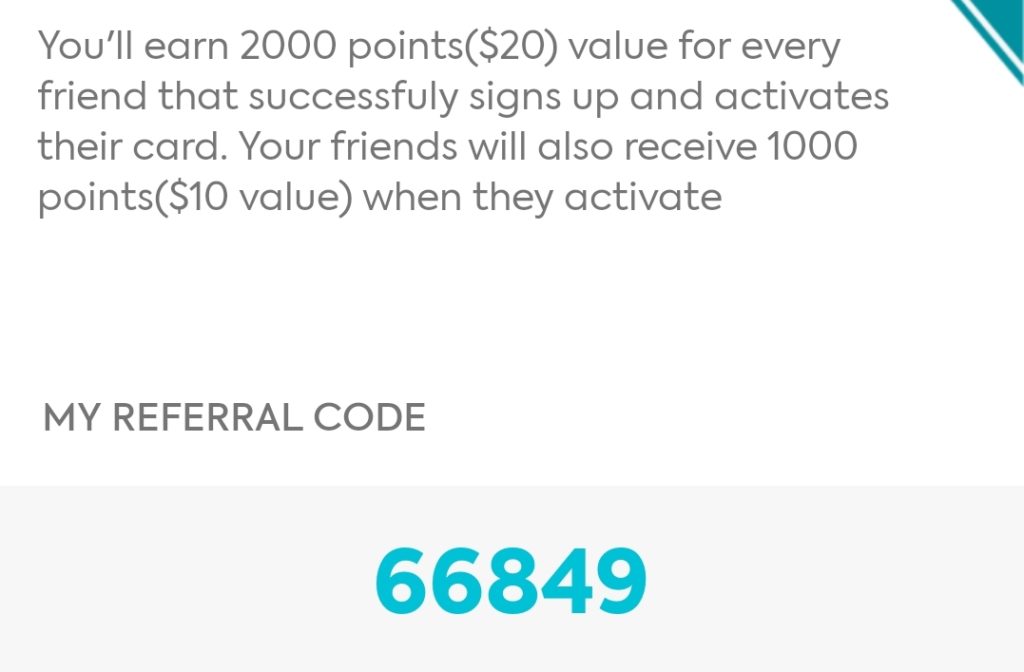

Just make sure to enter our Brim Referral Code (66849) so you don’t miss out on $10 in free points!

Brim Financial Review – Mastercard Options

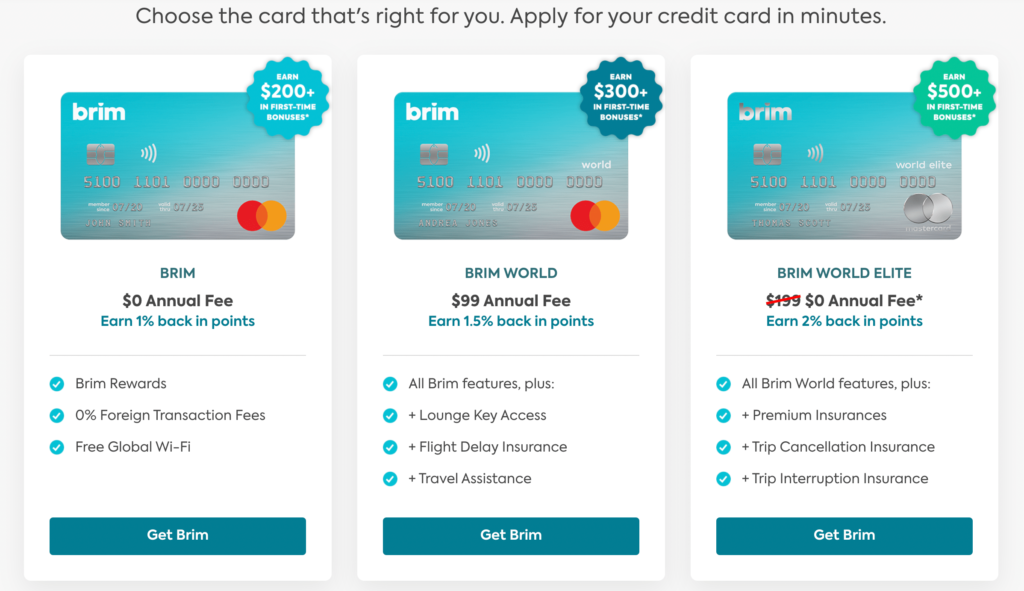

With 3 different Mastercards available, Brim basically has something for everyone.

Basic Brim Mastercard

- ✅ 1% in cashback on all purchases

- ✅ $0 Annual fee

- ✅ 0% Foreign transaction fees

- ✅ Access to InCard offers and eShop offers

- ✅ Free global Wi-Fi with Boingo

- ✅ Basic common-carrier, extended warranty, mobile device, and event ticket insurances

- ✅ Access to installment payments

Brim World Mastercard

- ✅ Everything included in the Brim Mastercard section

- ✅ An additional 0.5% cashback on all purchases (now 1.5% in total)

- ✅ Up to $300 in bonuses after your first purchases with participating retailers

- ✅ Access to over 1,000 airport lounges across the world through Mastercard Airport Experiences

- ✅ Flight delay insurance

- ✅ Travel assistance

Brim World Elite Mastercard

- ✅ Everything included in the Brim World Mastercard section

- ✅ An additional 0.5% cashback on all purchases (now 2% in total)

- ✅ Annual fee of $199 per year (WAIVED for the first year!)

- ✅ Premium insurances

- ✅ Trip cancellation insurance

- ✅ Trip interruption insurance

Brim Referral Code – $10 in Points!

Okay, so now that we all agree that Brim Mastercards are awesome, let’s talk about starting your account off with some extra points. If you use our Brim Referral Code, you’ll get $10 in points that you can apply against any purchase on your card. Whether you choose to treat your friend to a coffee or keep those points squirreled away for a rainy day, it never hurts to claim free money where you can!

For full disclosure, we will get $20 in points if you choose to use our brim referral code.

However, given that this card can save you hundreds of dollars in foreign exchange fees, annual fees, and cashback points, we think it’s only fair that you buy us lunch if you choose to sign up.

And, if you have any friends or family that are looking for a new credit card, definitely remember to give them your Brim Referral Code so you get $20 too!

Brim Financial FAQ

What is the Brim foreign exchange rate?

Brim Mastercards use the Mastercard exchange rate that applies for the day in question. Brim doesn’t tack on any additional fees, which makes it perfect for foreign purchases or travel.

How does Brim cashback work?

Basically, your percentage of cashback will depend on what card you own. You’ll get the base rate (as determined by your card), and then you can earn extra rewards by purchasing in-card or eShop offers.

Is Brim Financial a bank?

Brim Financial is not registered as a bank. It’s a Canadian fintech (financial technology) company.

How much is a Brim point worth?

Each Brim point is worth $0.01 CAD. This is a flat rate, and you never have to worry about your points depreciating in value as they change some policy.

How long does it take to get a Brim Mastercard?

Once you file your application, you should receive your notice of approval within 48 hours. Once approved, you’ll receive your card by mail within 3-5 business days. Then you’ll just have to fill out access the verification Brim Financial portal to activate your card.

Is it easy to get Brim Mastercard approval?

It’s not difficult to get approval if you opt for the basic Brim Mastercard. There are no income requirements, and you should be able to get approved for a $1000 limit with an average credit score.

Looking For More Canadian Promotions?

Brim Financial’s referral program is nice, but it’s certainly not the best on the market.

If you’re looking for more free money, then you should consider signing up for new bank account promotions, or other referral offers. Tangerine is currently offering up to $400 for clients that sign up for a no-fee chequing account, and Wealthsimple is currently offering a free stock valued up to $3000.

Or, if you’re looking for ways to make sustainable money online, check out our Hustles directory. We’ve got hundreds of ideas for ways to make money online, and we’ve made it easy for you to filter through them.

Happy hustling!